Understanding AO codes for PAN cards doesn't have to be complicated. If you're searching for how to find the AO code for your PAN card

The Permanent Account Number (PAN) card is a crucial national identifier that is held in significant status by the Income Tax Department of India. It is virtually impossible to operate in the financial markets in the country or conduct any financial operations due to a lack of this special identifier. In tune with the requirements of income tax returns, bank accounts, property buying/selling, loan applications, or availing of credit facilities, the PAN card is pivotal to financial identification as well as legal identity. As of March 2024, 74.67 crore PAN cards have been issued across the country.

Significance of Having a PAN Card

A PAN card, or Permanent Account Number card, is a unique 10-digit alphanumeric identifier issued by the Income Tax Department of India. It serves as a crucial financial identification document for individuals and entities, playing a pivotal role in various financial transactions and interactions with the government.

-

Proof of Identity

A PAN card is a universally accepted form of identification across India. It serves as proof of identity for various purposes, including opening bank accounts, applying for government services, and verifying identity during financial transactions. -

Tax Compliance

A PAN card is mandatory for filing income tax returns. It enables the government to track income and ensure that individuals and businesses pay their due taxes. It also helps in claiming tax refunds, if applicable. -

Financial Transactions

A PAN card is required for a wide range of financial transactions, such as:- Opening and operating bank accounts

- Investing in stocks, mutual funds, and other financial instruments

- Buying or selling property or vehicles above specified thresholds

- Making high-value purchases (e.g., jewellery, artwork) Obtaining loans or credit cards

- Obtaining loans or credit cards

-

Tracking Financial Activities

Your PAN card helps the government track your financial activities, which is essential for preventing tax evasion and money laundering. It aids in maintaining transparency and accountability in the financial system. -

Simplified Financial Processes

Providing your PAN card simplifies many financial processes, making it easier to open bank accounts, apply for loans, and complete other financial transactions. It streamlines interactions with financial institutions and the government. -

Avoiding Higher TDS

Without a PAN card, you may be subject to higher Tax Deducted at Source (TDS) rates on your income, which can reduce your in-hand income. Having a PAN card ensures that TDS is deducted at the appropriate rates.

Situations Requiring a Duplicate PAN Card

There are several scenarios where obtaining a duplicate PAN card online becomes necessary:

-

Loss or Misplacement

One of the most common reasons for needing a PAN card reprint online is its loss or misplacement. This can cause significant inconvenience, particularly if financial transactions are pending. -

Damage

Physical damage to the card, rendering it unreadable or unusable, is another situation where a PAN card reprint is required. Damage can happen or occur due to wear and tear, water damage, or other accidental factors. -

Changes in Personal Details

Sometimes, personal details such as name, address, or date of birth might need to be updated. Errors in these details or changes due to marriage, legal name change, or relocation necessitate the Pan card re-issuance. -

Theft

In cases where the PAN card is stolen, it is crucial to get a duplicate PAN card and prevent potential misuse. PAN card reprint is also required to ensure continuity in financial transactions.

How to Apply for a Duplicate PAN Card?

Applicants can choose between two primary modes to apply for a duplicate PAN card:

- Online Application to Order Duplicate PAN Card Online:

-

Offline Application:

- Submission of the application form at a PAN service centre.

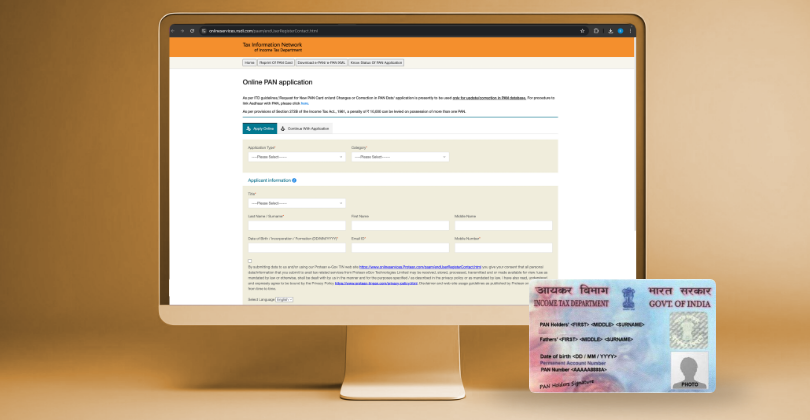

Step-by-Step Process for Online Application

- Visit the Official Website: Go to the NSDL or UTIITSL portal. Select the Appropriate Option: Choose the option for 'Reprint of PAN card/ PAN reprint'.

- Select the Appropriate Option: Choose the option for 'Reprint of PAN card/ PAN reprint'.

- Fill in the Form: Complete the application form with the necessary details such as PAN number, name, date of birth, and contact information.

- Upload Documents: Submit scanned copies of important documents, including proof of identity, address, and date of birth.

- Payment of Fees: Pay the applicable fees using online banking, credit card, debit card, or demand draft.

- Submission and Acknowledgment: Submit the form and note the acknowledgement number for tracking purposes.

- Dispatch of PAN Card: The PAN card reprint is sent to the applicant's registered address.

Required Documents

When you request a reprint of your PAN card, there are certain documents you have to submit. Applicants need to give proof of identity, address, and date of birth. Acceptable documents include:

- Proof of Identity: Passport, Aadhaar card, voter ID, etc.

- Proof of Address: Utility bills, bank statements, etc.

- Proof of Date of Birth: Birth certificate, enrolment certificate, etc.

Importance of PAN Card in Loan Applications

-

Verification of Identity

The PAN card reprint is essential for verifying the applicant's identity, ensuring that the information provided is accurate and legitimate. -

Creditworthiness Assessment

Financial institutions use the PAN card to check the credit history and financial behaviour of the applicant, which is crucial for assessing creditworthiness. -

Legal Requirement

According to the Know Your Customer (KYC) norms stipulated by the Reserve Bank of India (RBI), the PAN card is mandatory for loan applications. -

Avoiding Discrepancies

A valid PAN card ensures there are no discrepancies in the documentation, which can delay or affect the loan approval process.

Consequences of Not Having a PAN Card

-

Loan Application Rejection

Most financial institutions require a PAN card to process loan applications. Without it, applications are likely to be rejected. -

Higher TDS Rates

For financial transactions where PAN is not provided, higher Tax Deducted at Source (TDS) rates may apply, leading to a greater tax burden. -

Inability to File Income Tax Returns

Not having a PAN card can severely limit your financial activities. From opening bank accounts to filing income tax returns, this 10-digit alphanumeric code is essential for participating in the formal Indian economy.

Common Issues and Solutions

-

Delay in Receiving the Duplicate PAN Card

Applicants can know and track the application status online at the Tax Information Network of the Income Tax Department using the acknowledgement number provided at the time of submission. -

Incorrect Details on Duplicate PAN Card

If there are errors in the details on the duplicate PAN card, contact the PAN service provider immediately is essential to rectify them.

Don't Let a Missing PAN Card Hold You Back – Apply for Your Duplicate Now

Having a valid PAN card reprint is crucial for seamless financial transactions and loan-related activities. Ensuring that your PAN card is in good condition and contains accurate information is vital. In cases of loss, damage, or changes in personal details, applying for a PAN card reprint promptly is a proactive measure to avoid complications.If you're looking to apply for a personal loan, ensure your financial documents, including your PAN card, are in order. We at KreditBee can efficiently assist you in securing the financial support you need.

Frequently Asked Questions

You can apply online through the NSDL or UTIITSL websites to obtain a duplicate PAN card by submitting a form for changes or corrections in PAN data. Additionally, you need to provide supporting documents, pay the applicable fee, and follow the designated process for card issuance.

The immediate issuance of an original PAN card is not possible. However, you can apply for a PAN card through the expedited process offered by certain service providers for quicker processing, typically within a few days, upon payment of additional fees.

Yes, you can apply for a new PAN card online through the official websites of NSDL or UTIITSL by filling out the required application form and submitting the necessary documents electronically.

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.