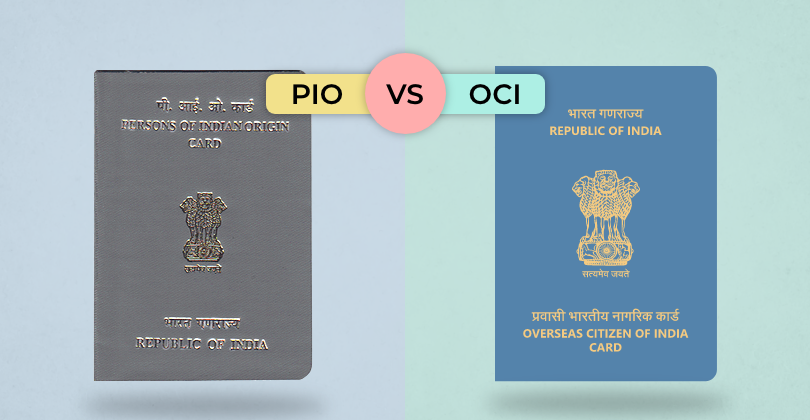

Are you of Indian origin and living abroad? You've probably come across terms like PIO and OCI. These cards offer different benefits, but it can

The decision to take an instant personal loan can be made easy with a little research and planning, you can easily meet your needs. Loans are a financial commitment that can have a significant impact on your overall monetary well-being. When seeking a loan, apart from the reason or purpose for borrowing, you need to keep a few things in mind, such as the amount you intend to borrow and the repayment tenure. Unlike other types of loans, personal loans are not restricted to what you can use it for. Therefore, you can utilise the loan depending on your individual circumstances and financial goals.

In this article, we will explore various reasons or purposes for taking a loan and help you determine which one might be the best fit for your specific needs.

The Importance of Responsible Borrowing

Before we delve into the various reasons for taking out an instant personal loan and what might be the best one for your situation, it is crucial to emphasise the importance of responsible borrowing. Regardless of the purpose, borrowing money is a financial commitment that comes with some sort of obligations.

It is not a decision to be made lightly, and one must carefully consider the impact on their overall financial health. The best reason to take out a loan should not only align with your immediate needs but also support your long-term financial goals, all while ensuring that you can comfortably meet the repayment terms.

📗 Related reading- How to Check Personal Loan Eligibility Online: A Comprehensive Guide

Travel

Travel is fun and a way to expand your horizons, but what if you do not have the funds at that moment? Taking personal loans can be helpful in such situations.

For instance, when you have a well-thought-out plan to celebrate a significant milestone or achievement with a trip, you can comfortably repay the personal loan in regular instalments. However, do ensure that you have a clear repayment strategy in place.

Responsible borrowing is about making sure the expenses align with your financial capacity and goals.

Education

Investing in education is generally considered a smart reason to take out a personal loan. Personal loans for education are often used to fund higher education, tuition fees, books, student exchange programs, or upskilling. These loans typically have lower interest rates and flexible repayment terms, making them a viable option for those looking to improve their career prospects.

Pursuing education can lead to increased earning potential, which can ultimately help you repay the personal loan and improve your overall financial well-being.

Emergency

Emergencies can strike at any time, and having access to quick funds can be a lifesaver. Whether it is a medical emergency, unexpected home repairs, or a sudden job loss, taking out a loan to cover these unforeseen expenses can be a reasonable decision.

Personal loans for emergencies can help you navigate challenging times and provide a safety net. However, it is essential to choose a loan with favourable terms and interest rates to minimise the financial burden.

Shopping

Taking out a personal loan for shopping, especially for non-essential items, is a decision that requires careful consideration. It can be a smart way to avoid depleting your savings all at once while indulging in shopping.

Consider planning your shopping expenses with manageable EMIs or personal loans for shopping so that they align with your financial goals. Ensure that you maintain a balanced approach and consider your overall financial well-being when making such choices.

Wedding

Weddings are beautiful and significant life events, often accompanied by considerable expenses. Many couples choose to take out a personal loan to ensure their special day is everything they've dreamed of. With careful planning and financial awareness, personal loans for weddings can be a helpful tool in making your wedding a memorable and joyous occasion.

By proper budgeting and exploring cost-saving options, you can achieve the wedding of your dreams while maintaining a healthy financial foundation for your future together.

Maternity

Preparing for the arrival of a new family member often comes with increased expenses, such as medical bills, baby supplies, and potential parental leave without pay. In some cases, taking out a personal loan for maternity can be a sensible choice and ensure a smooth transition into parenthood.

Hobbies

Engaging in hobbies and interests is an essential part of life, as it brings joy and fulfilment. If you are low on funds to invest in your passions, personal loans are a good option to finance them. Before borrowing, assess your options and consider essentials such as the amount of the loan and the repayment tenure.

Occasion

Occasional expenses, like celebrating birthdays, anniversaries, or other special events, can be a reason to take out a personal loan for occasions. These moments hold sentimental value and may warrant some financial splurging. Be sure to budget for these expenses in advance and calculate how you will need to borrow.

Gifting

Gift-giving is a meaningful way to express love and appreciation, and there may be times when you want to go the extra mile for a special gift. While it is thoughtful to give generous presents, you might have the funds at the very moment. In such instances, you can apply for personal loans and show your love and appreciation.

Opportunity

Sometimes, opportunities arise that can significantly impact your life, career, or financial future. These opportunities may require a financial investment, such as starting a new business or furthering your education. In such cases, taking out a personal loan for opportunities may prove wise. However, it is crucial to conduct thorough research and ensure that the potential benefits outweigh the associated costs and risks.

Low Salary

If you find yourself struggling to cover your basic living expenses due to a low salary, taking out a personal loan can be a way to bridge the financial gap. However, this should be seen as a temporary solution, and it is crucial to address the root causes of your low income, such as exploring opportunities for career advancement or additional income sources.

Home Renovation

Home renovations are a common reason to take out a loan. Improving your living space can increase the value of your property and enhance the quality of your life. Personal loans for home improvement are specifically designed for this purpose and often offer favourable terms. When used wisely, taking out a personal loan for home renovations can be a smart investment, but it is essential to budget and plan your project carefully to avoid overspending.

Conclusion

The best reason to say you need a loan varies from person to person, depending on individual circumstances, financial goals, and responsible borrowing practices. While some reasons, such as education and emergency expenses, are generally considered more prudent for borrowing, others, like shopping and gifting, should be approached with caution.

It is crucial to evaluate your needs, assess your financial situation, and explore alternative financing options before deciding to take out a loan. Ultimately, the best reason to borrow is one that aligns with your long-term financial well-being and helps you achieve your goals while maintaining a healthy financial balance.

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.