Understanding AO codes for PAN cards doesn't have to be complicated. If you're searching for how to find the AO code for your PAN card

In today's digital age, obtaining a PAN Card loan has become more accessible than ever, thanks to the convenience of online applications. A PAN (Permanent Account Number) card is a unique 10-character alphanumeric identifier issued by the Income Tax Department of India. It is essential for various financial transactions, and now, it can also be used as collateral to secure a loan.

📗 Related reading- 10 Factors to Consider Before Starting a Business with a Personal Loan

Understanding PAN Card Loans

Before delving into the application process, it is crucial to understand what a PAN Card loan entails. Essentially, a PAN card loan is a type of loan where the PAN card serves as collateral. Lenders consider the PAN card a reliable form of identification and proof of income, making it easier for individuals to secure a loan.

Eligibility Criteria

To apply for a PAN Card loan, certain eligibility criteria must be met. While the specific requirements may vary among lenders, the general criteria include:

-

Age: Applicants typically need to be between 21 and 60 years old.

-

Income: Lenders often have a minimum income requirement, ensuring that applicants have the financial means to repay the loan.

-

Credit Score: A good credit score enhances the chances of loan approval. While some lenders may consider applicants with lower credit scores, a higher score is generally preferred.

-

Employment: Stable employment is a significant factor. Lenders may require applicants to be employed for a certain period, usually at least six months to a year.

Steps to Apply for a PAN Card Loan Online

Now, let us understand the step-by-step process of applying for a PAN card loan online:

-

Research lenders: Start by researching and comparing various lenders that offer PAN card loans. Consider factors such as interest rates, loan tenure, and customer reviews. Opt for a reputable lender with favourable terms and conditions.

-

Check eligibility: Once you have identified and shortlisted potential lenders, check their eligibility criteria. Ensure that you meet the age, income, credit score, and employment requirements. This step helps you narrow down your options to lenders whose criteria align with your profile.

-

Gather documents: Prepare the necessary documents for the online application process. Common documents required for a PAN card loan application include:

-

PAN card

-

Aadhar card

-

Proof of address (utility bills, rent agreement, etc.)

-

Proof of income (salary slips, bank statements, income tax returns)

-

Passport-size photographs

-

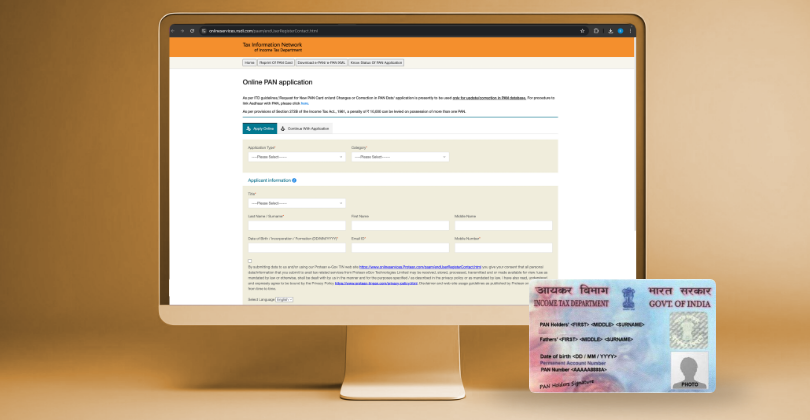

Visit the lender's website: Navigate to the official website of the chosen lender. Look for the 'Apply Now' or 'Online Application' section. Most lenders have a user-friendly interface, making it easy for applicants to navigate through the website.

-

Fill in the application form: Complete the online application form with accurate information. Double-check the details before submitting to avoid any errors. The application form typically includes fields for personal information, contact details, employment details, and financial information.

-

Upload documents: After filling in the application form, you will be prompted to upload the necessary documents. Ensure that the documents are clear, legible, and in the prescribed format. Uploading the required documents promptly contributes to a smooth application process.

-

KYC verification: Lenders often conduct a KYC process to verify document authenticity. Physical copies are necessary for verification. Some may use video verification or require a physical visit. Follow lender instructions carefully to complete this step, ensuring timely submission of physical documents.

-

Loan approval and disbursement: Once the lender completes the verification process and approves your loan application, they will communicate the terms and conditions. Review the loan agreement carefully before accepting it. Upon acceptance, the loan amount will be disbursed to your bank account.

Preparing these documents in digital format significantly speeds up the application process. However, it's imperative to note that physical copies must also be kept readily available for the KYC (Know Your Customer) process. The PAN Card, being a mandatory requirement, should be included in this set of physical documents.

Tips for a Successful PAN Card Loan Application

To increase your chances of a successful PAN card loan application, consider the following tips:

-

Maintain a good credit score: A higher credit score improves your creditworthiness, making it easier to secure a loan. Regularly check and monitor your credit score to address any discrepancies.

-

Accurate information: Provide accurate information in your application. Any inconsistencies or discrepancies may lead to rejection.

-

Document preparation: Before applying, ensure all necessary documents are in the correct format. Originals, not copies, are required to speed up verification. This step ensures authenticity and a smooth application process.

-

Compare interest rates: Different lenders offer different interest rates. Compare the rates offered by various lenders to choose the one that best suits your financial situation.

-

Read terms and conditions: Thoroughly read and understand the terms and conditions of the loan agreement. Pay attention to interest rates, repayment tenure, and any associated fees.

-

Timely repayment: Once you secure the loan, adhere to the repayment schedule. Timely repayments positively impact your credit score and financial credibility.

Conclusion

Applying for a PAN card loan online streamlines the borrowing process, providing individuals with a convenient way to secure funds using their PAN card as collateral. By understanding the eligibility criteria, following the application steps, and adhering to these tips. applicants can navigate the process with confidence.

As technology continues to shape the financial landscape, online loan applications, including those using PAN cards, offer a secure and efficient means of accessing financial assistance.

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.