Do you frequently find yourself stopping at toll booths, wishing there was a simpler way to handle toll payments? FASTag, the electronic toll collection system

Your identity is your most valuable asset. A secure and verified identity opens doors to opportunities. From accessing essential services like healthcare and education to pursuing your career goals, your identity serves as the key to your full potential and allows you to contribute to society.

In India, the Aadhaar card has become an essential document. Whether you're filing taxes, opening a bank account, or applying for a new phone connection, chances are you'll need to verify your Aadhaar. But how do you know your Aadhaar card is verified or that the details are accurate?

Let’s explore different verification methods, address common concerns, and highlight the benefits of keeping your Aadhaar information up-to-date.

Why Verify Your Aadhaar Card?

There are several reasons why verifying your Aadhaar card online might be necessary:

-

Confirmation of Details

Aadhaar card verification allows you to confirm the information registered with your Aadhaar number, including your name, date of birth, and address. This can be helpful if you suspect any discrepancies or need to update your details. -

Fighting Fraud

Aadhaar-based fraud is a growing concern. Online Aadhaar card number verification helps ensure its authenticity and reduces the risk of someone else misusing your identity. -

Government Services

Many government online portals require Aadhaar verification for accessing services or benefits. Verifying your Aadhaar beforehand ensures a smooth experience. -

KYC Compliance

Several financial institutions and service providers require Aadhaar number verification for Know Your Customer (KYC) compliance. Verifying your Aadhaar online streamlines this process.

According to Statista, 1.3 billion Aadhaar cards were generated till 2023. With such a vast number, ensuring the legitimacy of each card becomes vital. The online verification system offered by UIDAI empowers Aadhaar holders to take control of their information and safeguard themselves from potential misuse.

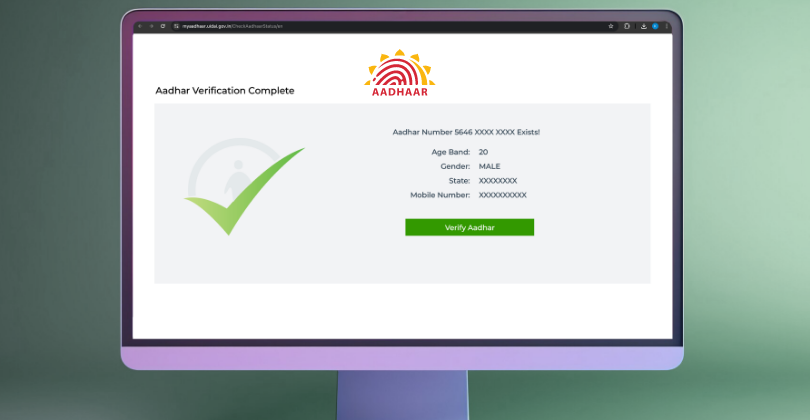

How to Verify an Aadhaar Card Online?

There are two primary methods to verify your Aadhaar card online, offering a convenient and secure way to confirm its authenticity. Whether you prefer a quick scan or a more detailed check, there's a method to suit your needs. Let's look at both options and see which one works best for you:

-

Verification by Aadhaar Number:

This is the most common method to verify Aadhaar and requires minimal information. Here's a step-by-step guide:-

Visit the official UIDAI website: UIDAI

-

Click on "Aadhaar Services" and select "Verify Aadhaar Number."

-

Enter your 12-digit Aadhaar number in the required field

-

Enter the captcha code on the screen

-

Select "Verify" to initiate the verification process

-

-

Verification by Name and Date of Birth (Limited Availability):

This method to verify Aadhaar is currently under development and might not be available on all sections of the UIDAI website. However, some banks and government portals might offer verification using your name and date of birth linked to your Aadhaar. Here are some additional points to remember:-

The process to verify Aadhaar is free of charge.

-

You don't need to create an account on the UIDAI website for Aadhaar number verification.

-

You can verify your Aadhaar card as many times as needed.

-

Benefits of Keeping Your Aadhaar Information Updated

Maintaining accurate and up-to-date information on your Aadhaar card offers several advantages, facilitating smooth access to government services and establishing identity in various transactions like:

-

Seamless Service Delivery

Accurate Aadhaar details ensure smooth processing of applications and minimise delays due to data discrepancies. -

Enhanced Security

Regularly updating your Aadhaar reduces the risk of identity theft and misuse. -

Improved Access to Government Benefits

Many government schemes require a verified Aadhaar for seamless access to benefits and subsidies. -

Get Your Funds Fast and Easy

With verified Aadhaar details, online digital lending platforms can process your loan application faster.

Addressing Common Concerns about Aadhaar Verification

-

Security of Aadhaar Data:

UIDAI employs robust security measures to protect Aadhaar data. However, it's crucial to practise safe online habits, such as avoiding sharing your Aadhaar number on unverified websites. -

Misuse of Aadhaar Information:

Verifying your Aadhaar helps identify any unauthorised usage. If you suspect misuse, you can report it to UIDAI for further investigation.. -

Frequency of Verification:

There's no mandated frequency for Aadhaar verification. However, it's recommended to verify your Aadhaar periodically, especially before using it for critical applications.

Take Charge of Your Digital Identity: Verify Your Aadhaar Today

The steps to verify Aadhaar online are simple and secure, and they allow you to take control of your identity information. By following the steps outlined above and keeping your Aadhaar details updated, you can ensure its validity and reap the benefits of this crucial document.

Remember, a verified Aadhaar translates to smoother service delivery, enhanced security, and easier access to various government programmes. It's a small step that can make a big difference in your life. So, why wait? Get your Aadhaar verified today and unlock a world of convenience.

Before you go…

1) Looking for quick and hassle-free personal loans? Get personal loans up to ₹5 lakh with competitive interest rates. Here’s a quick look into our loan offerings:

-

Personal Loan: KreditBee's Personal Loan can help you cover medical emergencies, travel costs, wedding expenses, home renovations, or consolidate debt with a single, convenient loan.

-

Flexi Personal Loan: It is a revolving credit line that allows you to borrow and repay funds as per your needs. You can only pay interest on the utilised amount.

-

Personal Loan for Salaried: Salaried individuals can get personal loans from KreditBee with minimal documentation and quick approvals.

-

Personal Loan for Self Employed: KreditBee offers personal loans for self-employed individuals with flexible repayment options.

-

Business Loan: With this business loan, you can meet your short-term or long-term business needs.

-

Need to consolidate debt or fund a small business venture? KreditBee has flexible loan options tailored just for you.

-

Planning a dream vacation or special event? KreditBee makes it easy to finance your plans with instant loans.

Frequently Asked Questions

To verify an Aadhaar card, you typically need your 12-digit Aadhaar number, which is printed on your Aadhaar Card. Additionally, you may need to provide other personal details like your name, date of birth, and registered mobile number for certain verification processes.

You can verify your Aadhaar online through the official UIDAI website. Visit the Aadhaar Kiosk section, select "Aadhaar services," and then choose "Aadhaar Verification." Enter your Aadhaar no. and the security code, and the system will provide the verification status.

Yes, Aadhaar Card verification conducted through the official UIDAI portal is secure. The UIDAI employs various security measures to protect personal information and ensure the integrity of the verification process.

Aadhaar Card verification is a process that authenticates the validity of an Aadhaar Card online. It ensures that the Aadhaar card provided by an individual is genuine and not forged.

Aadhaar Card verification is essential for various purposes, like opening bank accounts, applying for loan services, availing of subsidies, and more. Verifying Aadhaar Cards helps prevent identity fraud and ensures that only legitimate individuals access services and benefits.

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.