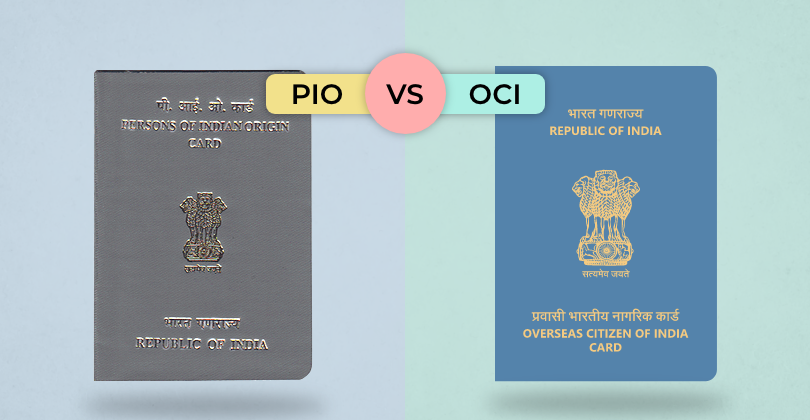

Are you of Indian origin and living abroad? You've probably come across terms like PIO and OCI. These cards offer different benefits, but it can

Financial literacy is a crucial aspect of personal finance that involves understanding and managing one's financial resources effectively. It encompasses a range of skills and knowledge that enable individuals to make informed and wise decisions about their money. From budgeting and saving to investing and retirement planning, financial literacy plays a pivotal role in achieving financial well-being.

In this article, we will explore what financial literacy entails and why it is so important in personal finance.

📗 Related reading- 10 Factors to Consider Before Starting a Business with a Personal Loan

Defining Financial Literacy

Financial literacy can be defined as the ability to understand and use various financial skills, including personal financial management, budgeting, and investing. It goes beyond just knowing about money; it involves the practical application of that knowledge in making sound financial decisions. A financially literate individual is equipped with the skills to navigate the complex world of personal finance confidently.

One of the foundational elements of financial literacy is understanding the basics of budgeting. This includes creating a realistic budget, tracking expenses, and managing income effectively. Without a solid grasp of budgeting, individuals may find themselves struggling to make ends meet, accumulating debt, or failing to save for future goals.

Another critical component of financial literacy is the ability to interpret financial statements and documents. This includes understanding bank statements, credit card statements, and investment account summaries. Financially literate individuals can analyse these documents to assess their financial health, identify areas for improvement, and detect any irregularities.

Furthermore, financial literacy involves knowledge about credit and debt management. This includes understanding credit scores, interest rates, and the impact of debt on one's overall financial well-being. A financially literate person can make informed decisions about borrowing, such as taking on a mortgage or using credit cards responsibly.

Investing is also a key aspect of financial literacy. Understanding different investment options, risk tolerance, and long-term financial goals is crucial for building wealth over time. Financially literate individuals can navigate the stock market, mutual funds, and other investment vehicles with confidence, ensuring their choices are aligned with their financial objectives.

The Importance of Financial Literacy

Financial literacy is not just a theoretical concept; it has tangible and far-reaching implications for individuals and society as a whole. Here are some compelling reasons why financial literacy is of utmost importance.

-

Empowerment through knowledge

Financial literacy empowers individuals by providing them with the knowledge and skills necessary to take control of their financial lives. When people understand how money works, they can make informed decisions that align with their goals and values.

-

Preventing financial pitfalls

Lack of financial literacy can lead to costly mistakes and financial pitfalls. Individuals who are unaware of the consequences of their financial decisions may find themselves in debt, facing bankruptcy, or struggling to meet basic needs. Financial literacy serves as a shield against such pitfalls.

-

Building a secure future

Planning for the future is a fundamental aspect of personal finance, and financial literacy is the cornerstone of effective planning. Whether it is saving for education, buying a home, or preparing for retirement, a financially literate individual can navigate these milestones with confidence, building a secure and stable future.

-

Enhancing economic stability

On a broader scale, a population that is financially literate contributes to economic stability. When individuals manage their finances responsibly, it has a positive impact on the overall economy. Reduced debt levels, increased savings, and informed investment decisions all contribute to a more robust and stable economic environment.

-

Making informed decisions

Financial decisions, whether big or small, have long-term consequences. Financially literate individuals can weigh the pros and cons of different choices, considering the impact on their overall financial well-being. This ability to make informed decisions is a key benefit of financial literacy.

-

Navigating a complex financial landscape

The financial landscape is constantly evolving, with new products, services, and regulations. Financial literacy equips individuals with the skills to navigate this complexity, ensuring that they can adapt to changes and make wise choices in the face of evolving financial circumstances.

-

Reducing stress and anxiety

Financial stress is a significant source of anxiety for many individuals. Financial literacy helps alleviate this stress by providing a sense of control and confidence. When people understand their financial situation and have a plan in place, it reduces the uncertainty that often leads to stress and anxiety.

-

Encouraging responsible citizenship

Financially literate individuals are more likely to be responsible citizens. They are better equipped to contribute to their communities, support local businesses, and engage in civic activities. Financial literacy fosters a sense of responsibility and accountability in both personal and societal contexts.

Conclusion

Financial literacy is a fundamental skill that everyone should strive to develop. It goes beyond mere awareness of financial concepts; it involves actively applying that knowledge to make informed money decisions.

The importance of financial literacy cannot be overstated, as it empowers individuals, prevents financial pitfalls, and contributes to economic stability. As we navigate an increasingly complex financial world, investing in financial literacy is an investment in personal and societal well-being.

The importance of financial literacy cannot be overstated, as it empowers individuals, prevents financial pitfalls, and contributes to economic stability. As we navigate an increasingly complex financial world, investing in financial literacy is an investment in personal and societal well-being.

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.