Understanding AO codes for PAN cards doesn't have to be complicated. If you're searching for how to find the AO code for your PAN card

With the advancement of technology, financial transactions are nowadays easier and more convenient to make. Among the notable instruments utilised in the Indian financial environment, the Permanent Account Number card, commonly referred to as a PAN card, stands out.

The Income Tax Department issues this one-of-a-kind number, which is ten digits long and in alphanumeric format, and it is crucial in matters of credit, such as borrowing. The steps involved in PAN card verification online have simplified several activities by enhancing security, thus promoting fast and safe transactions.

Understanding PAN Card Verification

PAN card verification is a process to authenticate the identity of an individual or entity through their PAN card details. This verification is essential for various financial transactions, including opening bank accounts, filing taxes, and applying for loans. The PAN card acts as proof of identity and helps maintain transparency in financial dealings.

Types of PAN Verification

-

Online PAN Verification by PAN No.:

This method confirms the authenticity of a PAN card holder by validating their PAN number through secure online portals. It's a quick and reliable way to verify the information associated with a PAN card.

-

PAN Card Mobile Number Verification:

This process involves linking and verifying the PAN card with the cardholder's mobile number. It ensures that communication and transactions are secure and directed to the rightful owner.

-

PAN Verification by Name:

In cases where the PAN number is unavailable, the verification can be done using the individual's name. This method is less common but equally important for ensuring accuracy in identity verification.

-

e PAN Verification:

This is an electronic method of verifying PAN card details. It involves checking the PAN information through online databases and ensuring real-time verification.

Importance of PAN Card Verification in Loan Applications

PAN card verification plays a crucial role when applying for a loan, whether a personal loan, a home loan, or any other type. Lenders authenticate the borrower's identity and financial history to mitigate risks and ensure that loans are granted to eligible applicants.

Here's why PAN card verification is essential in the loan process:

-

Identity Verification:

The PAN card serves as proof of identity. Verifying the PAN ensures that the loan is being processed for the right individual, reducing the risk of identity theft and fraud.

-

Creditworthiness Check:

PAN card details are used to fetch the applicant's credit report. This report provides insights into the borrower's credit history, repayment behaviour, and overall financial health, aiding lenders in making informed decisions.

-

Regulatory Compliance:

Financial institutions have to comply with KYC (Know Your Customer) norms mandated by regulatory bodies. PAN card verification is critical to KYC, ensuring that the lender adheres to legal requirements.

-

Preventing Fraud:

Verifying the PAN card helps detect any discrepancies or fraudulent activities associated with the applicant's identity. This adds a layer of security to the loan approval process.

-

Streamlining the Process:

Online PAN verification speeds up the loan application process. It eliminates the need for manual verification, reduces paperwork, and enables quicker loan disbursals.

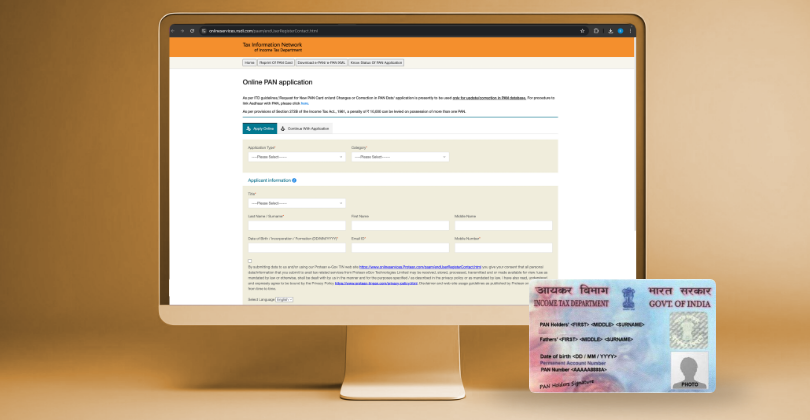

How to Perform PAN Card Verification Online

In India, a staggering 74.67 crore PAN cards have been issued as of 2023-2024. Fortunately, the process of verifying your PAN online is simple and user-friendly. To help you navigate this process, here's a step-by-step guide:

-

Step 1: Visit the Official Website

Visit the Income Tax Department's official website or authorised third-party portals that provide PAN verification services. These platforms offer a secure environment for conducting PAN verifications.

-

Step 2: Select the Verification Method

Choose the appropriate verification method based on the information you have. You can verify PAN by PAN number, name, or mobile number. For loan applications, PAN number verification is the most commonly used method.

-

Step 3: Enter the Required Details

Input the necessary details in the specified fields. For PAN no. verification, enter the PAN number. For PAN verification by name, provide the individual's full name as it appears on the PAN card.

-

Step 4: Submit the Information

Once you have filled in the details, submit the form. The system will process the information and verify the details against the official database.

-

Step 5: Receive Verification Status

After submission, you will receive a verification status. If the details match, the PAN card is verified successfully. In the event of any discrepancies, you may need to recheck the information entered or contact the relevant authorities.

The Role of PAN Verification in Digital Lending Platforms

Digital lending platforms have revolutionised the way loans are processed and disbursed. These platforms leverage technology to provide quick and hassle-free loan services. PAN card verification online is integral to these platforms, ensuring seamless operations and enhanced security. Here's how PAN verification benefits digital lending:

-

Instant Verification

Digital lending platforms can instantly verify the PAN details of the applicants, reducing the turnaround time for loan approvals.

-

Enhanced Security

By verifying the PAN card online, digital lenders can ensure that the applicant's identity is legitimate, minimising the risk of fraud.

-

Improved Customer Experience

Online PAN verification simplifies the application process for borrowers, providing a smooth and user-friendly experience.

-

Compliance with Regulations

Digital lenders must comply with KYC norms. PAN verification ensures that these platforms adhere to regulatory standards.

Your PAN Card is Your Key to Quick Loans – Verify it Now

PAN card verification online is a critical component in the financial ecosystem, especially in the context of loan applications. If you're looking for a reliable and hassle-free loan experience, look no further than KreditBee.

With a seamless online application process, quick PAN card verification, and instant loan approvals, KreditBee ensures that your monetary needs are met with ease and security. Get in touch with us today and take the first step towards securing your loan effortlessly.

Frequently Asked Questions

Yes, you can check your PAN card details online through the Income Tax Department's official website or authorised third-party portals. Enter your PAN number or other required details for verification.

To verify the signature on your e-PAN card, you can use Adobe Acrobat Reader or any PDF reader software that supports digital signatures. Open the e-PAN card PDF file, click on the signature field, and select "Verify Signature" to confirm its authenticity.

You can download your PAN card details from the official website of the Income Tax Department by logging in with your PAN number, date of birth, and captcha code. Alternatively, you can use the PAN card download facility authorised third-party portals provide.

AUTHOR

KreditBee As a market leader in the Fintech industry, we strive to bring you the best information to help you manage finances better. These blogs aim to make complicated monetary matters a whole lot simpler.